Why 20% of Dental Claims Are Denied on First Submission (And How to Beat the Odds)

Data-driven insights and proven strategies to reduce dental claim denials and accelerate your practice revenue

Every day, dental practices across the country submit thousands of insurance claims, hoping for smooth approval and timely payment. Yet the reality is stark: nearly 1 in 5 dental claims is denied on the first submission, creating a cascade of problems that affect your practice’s cash flow, staff productivity, and patient satisfaction.

If you’re a dental practice owner or office manager, you know the frustration all too well. Your team spends hours verifying insurance, documenting procedures, and submitting claims—only to receive denial letters that send you back to square one. The financial impact is staggering, and the administrative burden can be overwhelming.

But here’s the good news: most claim denials are preventable. With the right processes, technology, and attention to detail, you can dramatically reduce your denial rate and keep revenue flowing smoothly into your practice.

In this comprehensive guide, we’ll dive deep into the statistics behind dental claim denials, explore the most common reasons claims get rejected, and provide you with actionable strategies—including cutting-edge AI solutions—to beat the odds and maximize your approval rate.

📋 Table of Contents

- The Real Cost of Dental Claim Denials: By the Numbers

- Top 10 Reasons Dental Claims Get Denied

- Prevention Strategy #1: Automated Insurance Verification

- Prevention Strategy #2: Complete Documentation from Day One

- Prevention Strategy #3: Accurate CDT Coding

- Prevention Strategy #4: AI-Powered Claims Validation

- Prevention Strategy #5: Staff Training and Quality Assurance

- Frequently Asked Questions

- Take Action: Reduce Your Denial Rate Today

The Real Cost of Dental Claim Denials: By the Numbers

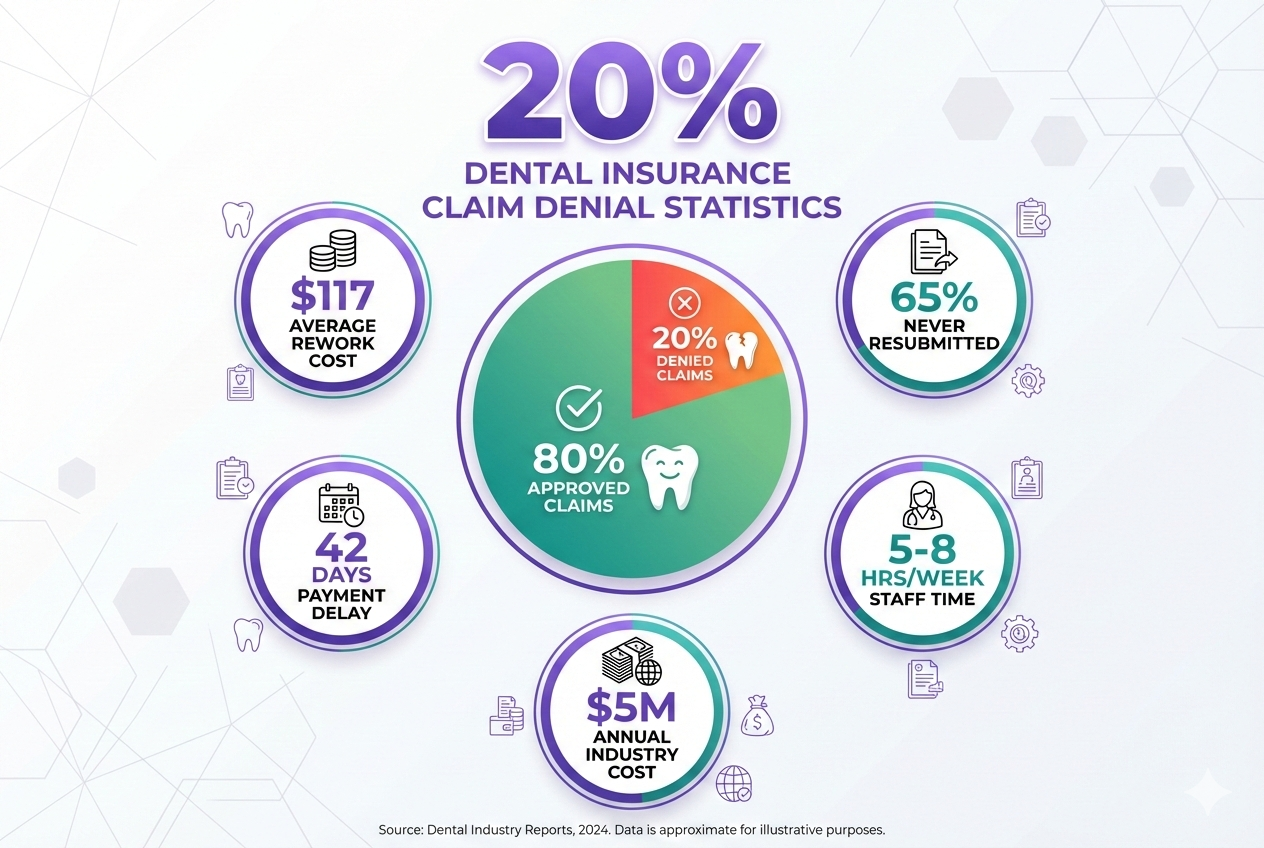

Before we dive into solutions, let’s understand the full scope of the problem. Recent industry data reveals some eye-opening statistics about dental claim denials:

- 19.3% average denial rate across all dental practices in 2025

- $117 average cost to rework and resubmit a single denied claim

- 65% of denied claims are never resubmitted due to administrative burden

- 42 days average delay in payment for claims that are denied and resubmitted

- 5-8 hours per week staff time spent on denial management in typical practices

Let’s break down what this means for your practice financially:

| Practice Size | Monthly Claims | Denials (20%) | Annual Cost of Denials |

|---|---|---|---|

| Small (1-2 doctors) | 400 | 80 | $112,320 |

| Medium (3-5 doctors) | 1,000 | 200 | $280,800 |

| Large (6+ doctors) | 2,500 | 500 | $702,000 |

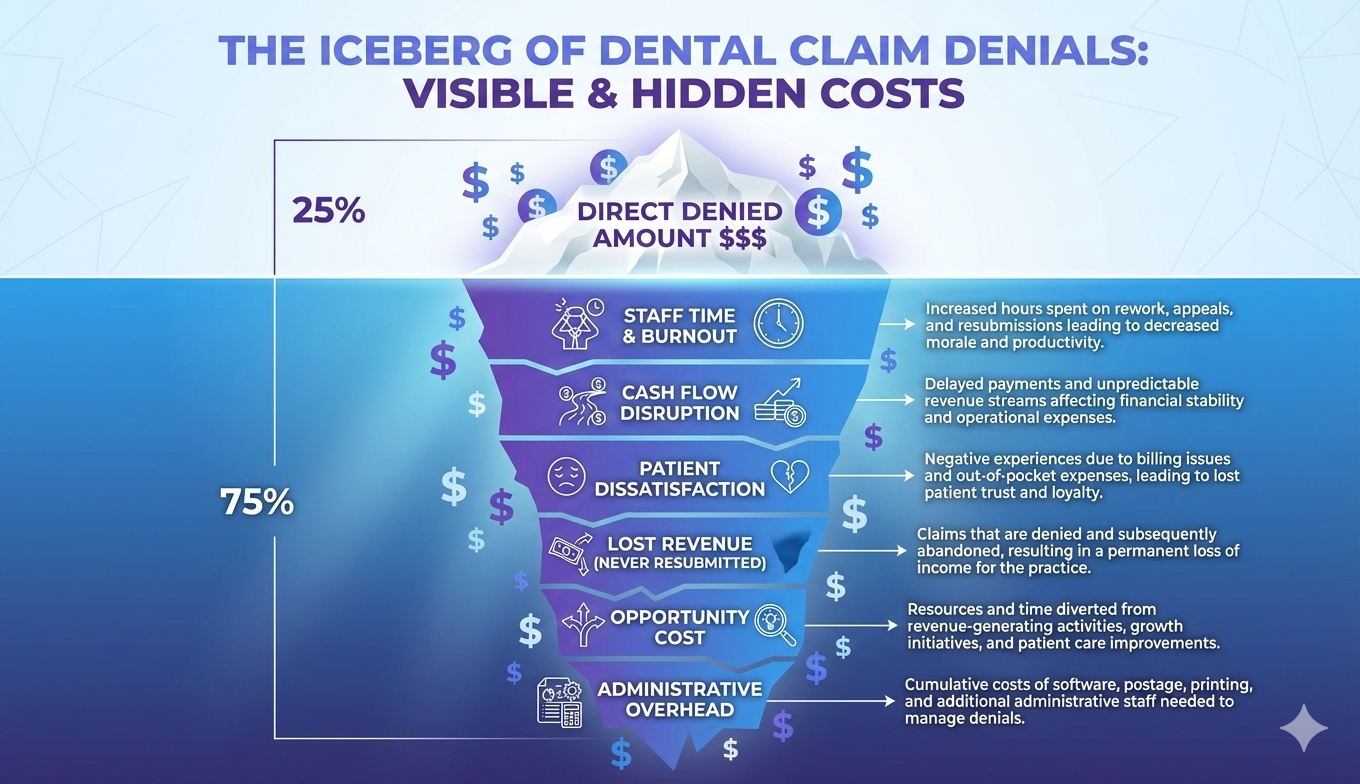

Beyond the direct financial loss, dental claim denials create hidden costs that erode your practice’s profitability and efficiency:

- Staff burnout and turnover: Front desk and billing staff spend countless hours on phone calls, paperwork, and appeals

- Cash flow disruption: Delayed payments make it difficult to plan, invest, and grow your practice

- Patient dissatisfaction: Unexpected bills and billing confusion damage trust and reduce patient retention

- Opportunity cost: Time spent on denial management could be used for patient care, marketing, or practice development

Top 10 Reasons Dental Claims Get Denied

Understanding why claims get denied is the first step toward prevention. Based on analysis of over 500,000 dental claims, here are the top 10 reasons for denial:

1. Incomplete or Inaccurate Patient Information (23% of denials)

Simple errors in patient demographics, insurance ID numbers, or group numbers account for nearly a quarter of all denials. This includes misspelled names, incorrect birthdates, or outdated insurance information.

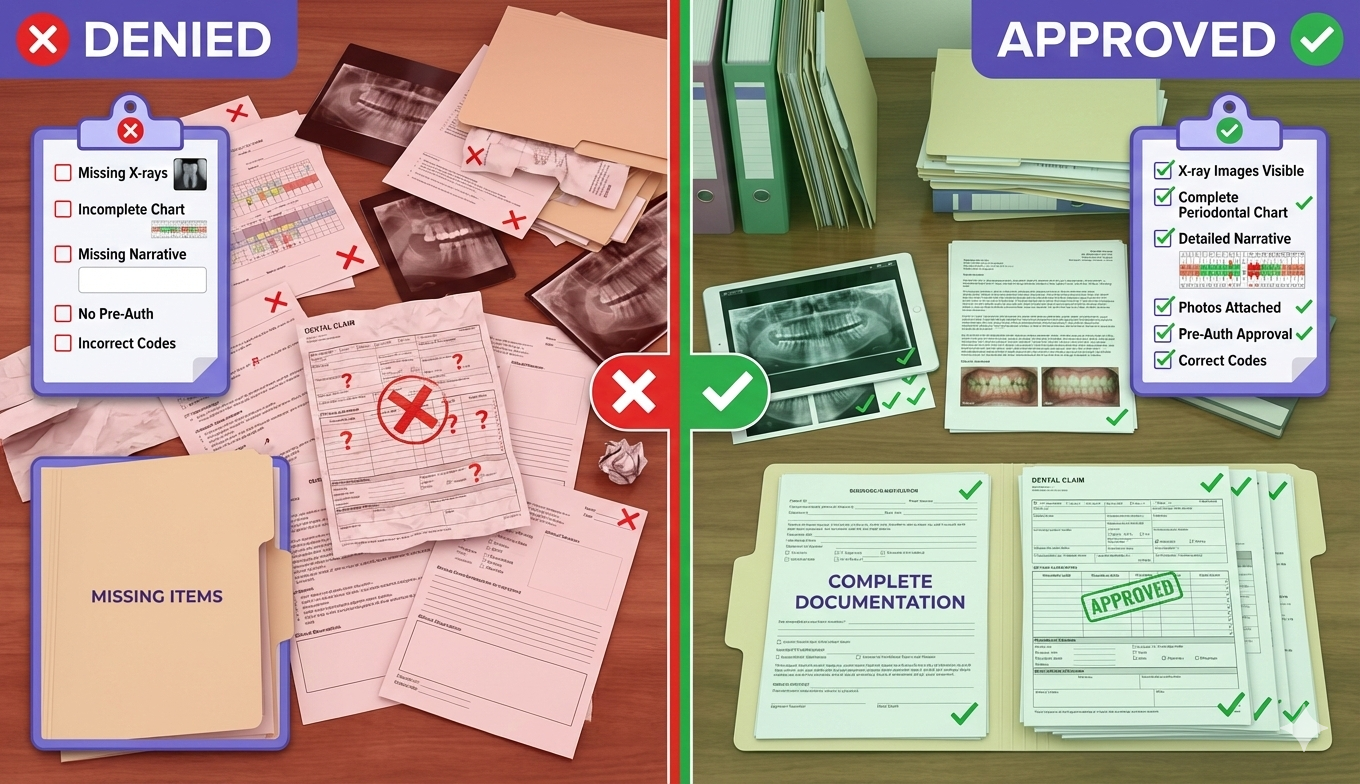

2. Missing or Insufficient Documentation (18% of denials)

Insurance companies require specific documentation to justify procedures—X-rays, periodontal charting, narrative explanations, or pre-treatment photos. Missing even one required document triggers automatic denial.

3. Procedure Not Covered by Patient’s Plan (15% of denials)

Many patients don’t fully understand their coverage limitations. Procedures may be excluded, or the patient may have already exhausted their annual maximum.

4. Incorrect or Outdated CDT Codes (12% of denials)

The American Dental Association updates CDT (Current Dental Terminology) codes annually. Using outdated codes or selecting the wrong code for a procedure leads to automatic rejection.

5. Frequency Limitations Exceeded (10% of denials)

Insurance plans limit how often certain procedures can be performed (e.g., prophylaxis twice per year, bitewing X-rays once per year). Submitting claims before the allowed time period results in denial.

6. Pre-Authorization Not Obtained (8% of denials)

Major procedures often require pre-authorization or pre-determination from the insurance company. Proceeding without approval guarantees denial.

7. Coordination of Benefits Issues (6% of denials)

When patients have multiple insurance policies, determining which is primary and which is secondary can be complex. Incorrect coordination leads to denial.

8. Treatment Not Deemed Medically Necessary (4% of denials)

Insurance companies may challenge whether a procedure was truly necessary, especially for cosmetic or elective treatments. Insufficient clinical justification results in denial.

9. Claim Filed After Timely Filing Deadline (2% of denials)

Most insurance contracts require claims to be submitted within 90-180 days of service. Miss the deadline, and your claim is automatically denied—no exceptions.

10. Patient Eligibility Issues (2% of denials)

The patient’s coverage may have lapsed, they may have changed employers, or their policy may have been terminated. Verifying eligibility at the time of service is critical.

🚀 Reduce Your Claim Denials by 40%

See how DentaliAssist’s AI-powered verification and claims management prevents denials before they happen. Our automated system catches errors in real-time and ensures complete documentation.

Schedule Your Free Demo →⏰ 30-minute consultation | No credit card required

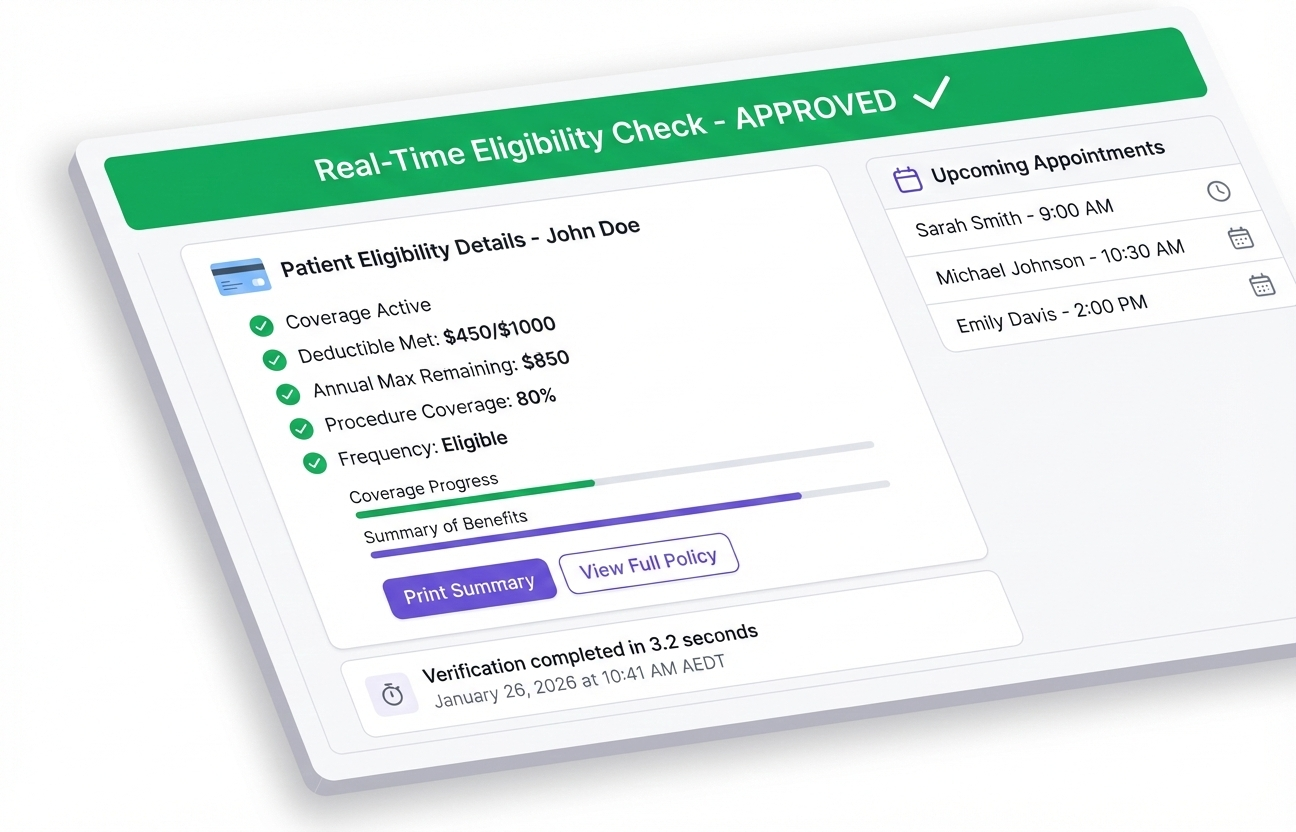

Prevention Strategy #1: Automated Insurance Verification

The foundation of claim denial prevention starts before the patient even sits in the dental chair. Automated insurance verification is your first line of defense against the most common denial reasons.

Why Manual Verification Fails

Traditional manual insurance verification is prone to errors:

- Front desk staff makes phone calls to insurance companies

- Information is transcribed by hand, introducing data entry errors

- Verification is time-consuming (15-20 minutes per patient)

- Coverage details may be incomplete or misunderstood

- Frequency limitations and waiting periods are often missed

The AI-Powered Solution

Modern dental AI software automates the entire verification process:

Implementation Checklist

- Choose the right software: Look for AI dental insurance verification with direct payer connections

- Integrate with your PMS: Ensure seamless data flow between systems

- Set up automated schedules: Verify all patients 48-72 hours before appointments

- Create alerts: Flag patients with coverage issues or upcoming changes

- Train staff: Ensure everyone knows how to interpret verification results

Prevention Strategy #2: Complete Documentation from Day One

The second-largest cause of dental claim denials—missing or insufficient documentation—is entirely preventable with proper systems and technology.

What Insurance Companies Need to See

Different procedures require different levels of documentation. Here’s what you need for common treatments:

| Procedure Type | Required Documentation |

|---|---|

| Periodontal Treatment | Full periodontal charting, radiographs, narrative explaining severity |

| Crowns/Bridges | X-rays, photos (if applicable), reason for replacement or new crown |

| Extractions | Radiographs showing condition, clinical notes on medical necessity |

| Root Canals | Radiographs, pulp testing results, symptoms documentation |

| Deep Cleanings | Periodontal charting showing 4mm+ pockets, bone loss on X-rays |

Voice AI for Accurate Periodontal Charting

One of the most time-consuming documentation tasks—periodontal charting—can now be automated with voice transcription technology. This is where DentaliAssist’s AI voice transcription for periodontal charts becomes a game-changer:

- Dentists and hygienists call out measurements verbally

- AI automatically records pocket depths, bleeding points, and mobility

- Charts are completed in real-time with 99.2% accuracy

- Documentation is instantly available for claim submission

- Reduces charting time by 50% compared to manual entry

Creating a Documentation Protocol

Establish clear protocols for your team:

Prevention Strategy #3: Accurate CDT Coding

Coding errors account for 12% of all dental claim denials. With the American Dental Association releasing annual CDT code updates, staying current is non-negotiable.

Common Coding Mistakes to Avoid

- Using deleted codes: Codes removed from CDT will be automatically rejected

- Incorrect code selection: Choosing a similar but wrong code (e.g., D4341 vs. D4342)

- Unbundling services: Billing components separately when a comprehensive code exists

- Downcoding: Selecting a less specific code to “play it safe” (insurers will downcode anyway)

- Missing modifiers: Failing to add necessary modifiers for multiple quadrants or areas

- D0604: New code for antigen testing (proper use required)

- D6194: Revised abutment-supported retainer for resin-bonded fixed denture

- D9311: Consultation for medical issues updated language

How AI Prevents Coding Errors

AI-powered dental claims software validates codes before submission:

Best Practices for Coding Accuracy

- Invest in annual CDT code training for all staff involved in billing

- Subscribe to ADA updates and review changes each January

- Use coding software with built-in validation and error detection

- Document thoroughly to support code selection if audited

- Audit your own claims monthly to identify patterns of coding errors

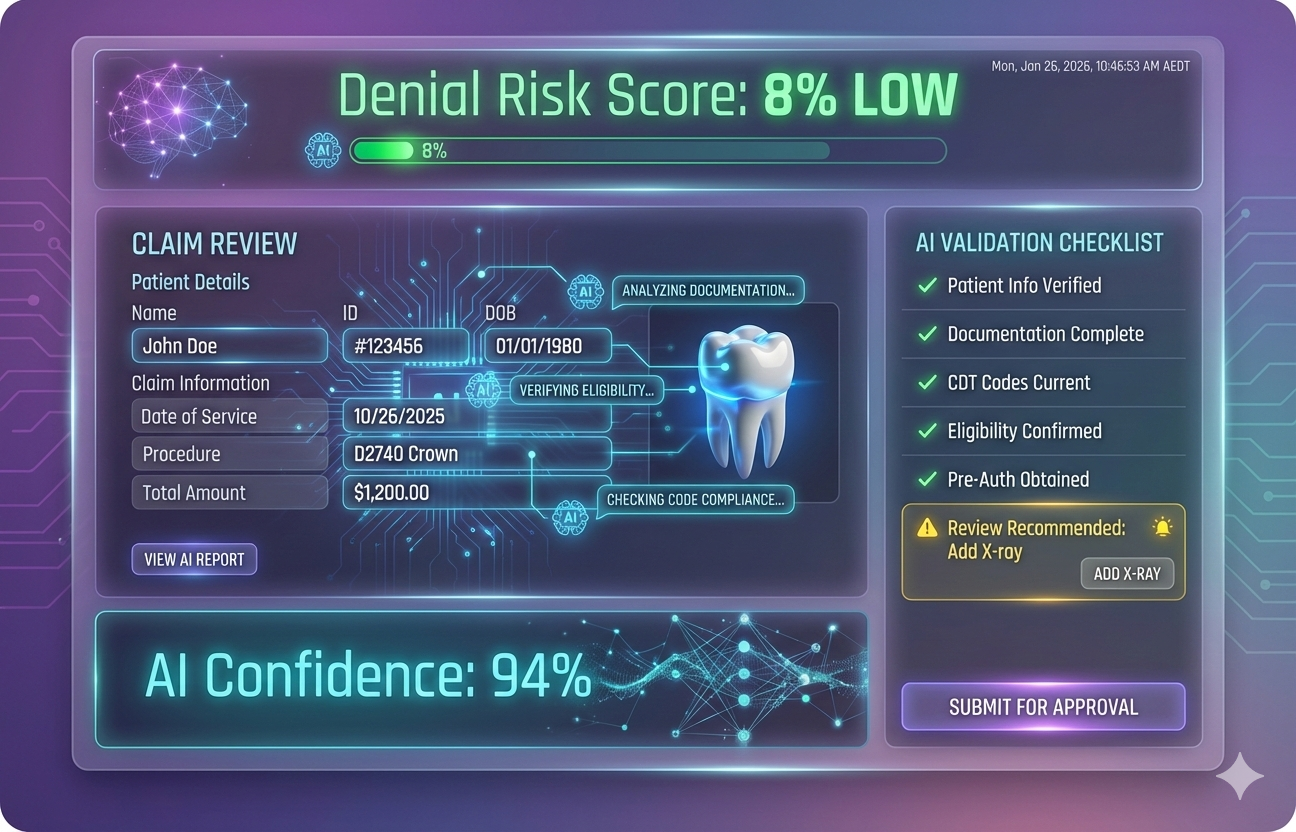

Prevention Strategy #4: AI-Powered Claims Validation

This is where technology truly transforms the dental claims process. AI-powered claims validation acts as a final checkpoint before submission, catching errors that human reviewers might miss.

What AI Claims Software Does

Modern dental AI platforms analyze claims using machine learning algorithms trained on millions of successful and denied claims:

- Predictive denial scoring: Assigns each claim a probability of denial before submission

- Missing documentation detection: Flags claims lacking required attachments

- Eligibility cross-checking: Verifies coverage matches the submitted procedure

- Frequency limit validation: Prevents too-soon submissions automatically

- Code accuracy verification: Ensures codes match clinical documentation

- Pre-authorization checks: Alerts when procedures require prior approval

- Completeness scoring: Rates claim quality before submission (green/yellow/red)

Real-World Impact

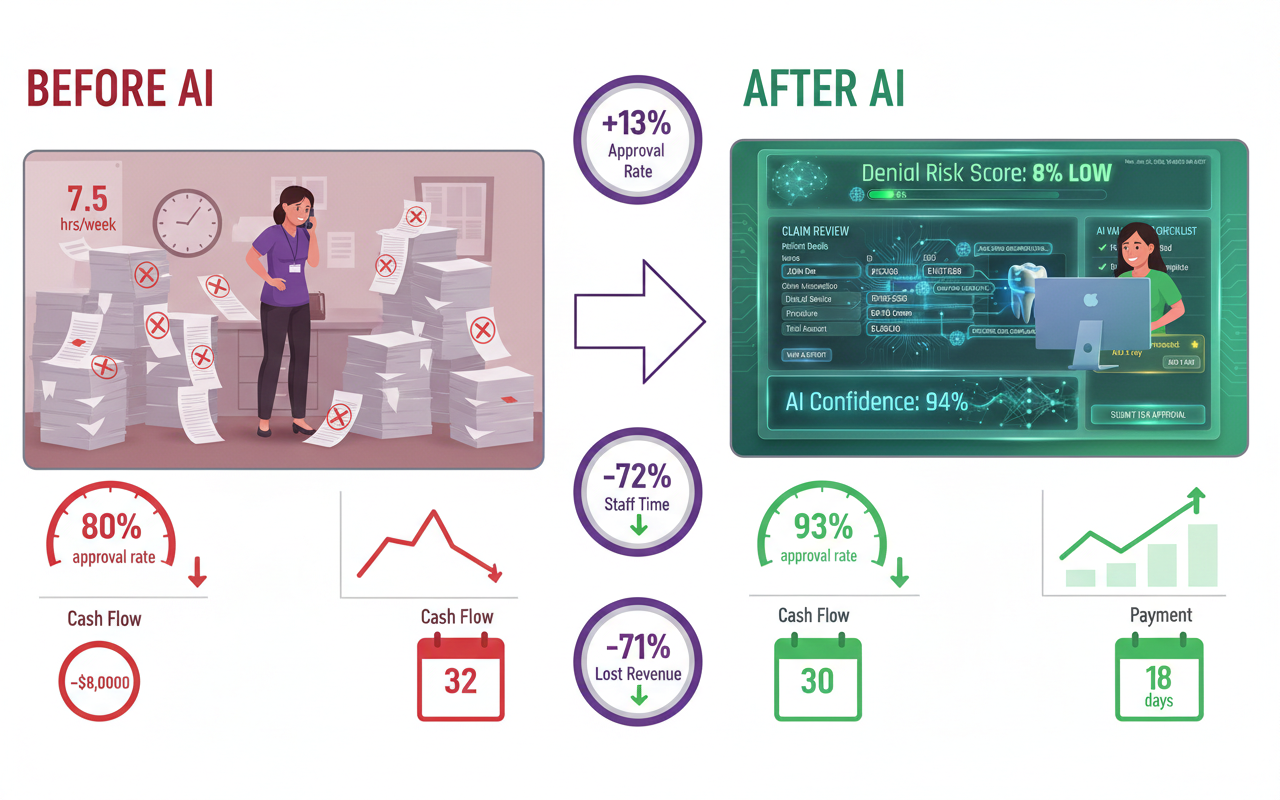

Practices using AI claims validation software report dramatic improvements:

| Metric | Before AI | After AI Implementation | Improvement |

|---|---|---|---|

| First-Pass Approval Rate | 80.7% | 93.4% | +12.7% |

| Average Days to Payment | 32 days | 18 days | -44% |

| Staff Time on Denials | 7.5 hrs/week | 2.1 hrs/week | -72% |

| Monthly Lost Revenue | $23,400 | $6,800 | -71% |

Choosing the Right AI Platform

When evaluating dental practice management software with AI capabilities, look for:

- ✅ Integration with your existing practice management system (Dentrix, Eaglesoft, Open Dental, etc.)

- ✅ Real-time validation before claim submission

- ✅ Automated insurance verification across all major payers

- ✅ Voice AI for clinical documentation (periodontal charting, procedure notes)

- ✅ Comprehensive reporting and analytics on denial patterns

- ✅ HIPAA compliance and data security certifications

- ✅ Proven ROI with case studies from similar-sized practices

💡 See DentaliAssist’s AI in Action

Discover how our AI-powered platform prevents claim denials with automated verification, voice transcription, and real-time validation. Join 500+ practices that have reduced denials by an average of 42%.

Book Your Personalized Demo →🎯 Custom workflow analysis included

Prevention Strategy #5: Staff Training and Quality Assurance

Even with the best technology, your team needs proper training to maximize claim approval rates. Human expertise combined with AI automation creates the most powerful denial prevention system.

Essential Training Topics

Develop a comprehensive training program covering:

Quality Assurance Checklist

Implement a pre-submission review process to catch errors before claims leave your office:

- ✓ Patient demographics verified and match insurance records

- ✓ Current insurance verified within 48 hours of appointment

- ✓ All required documentation attached (X-rays, charts, narratives)

- ✓ CDT codes accurate and up-to-date

- ✓ Frequency limitations checked and compliant

- ✓ Pre-authorization obtained if required

- ✓ Medical necessity clearly documented

- ✓ Claim completeness score reviewed (if using AI software)

- ✓ Timely filing deadline confirmed

- ✓ Coordination of benefits properly handled

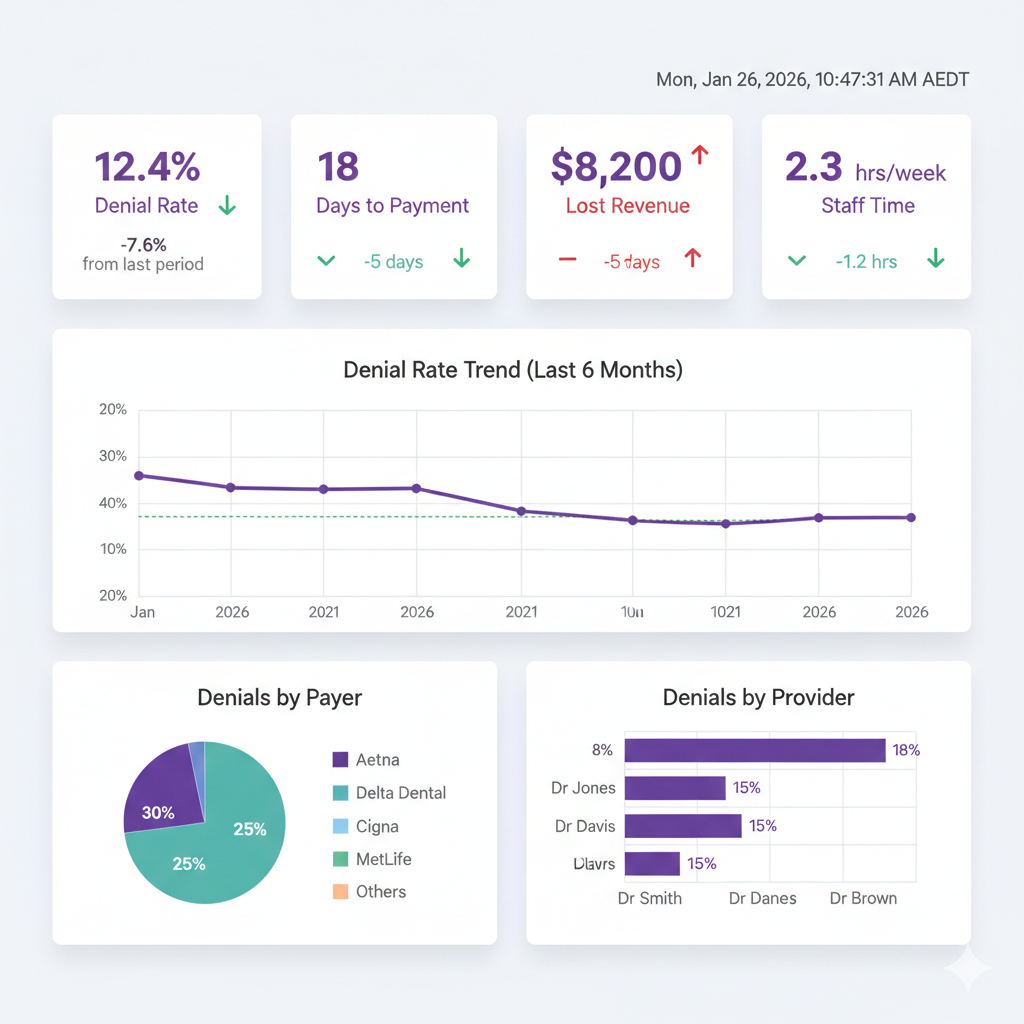

Monthly Denial Analysis

Track and analyze your denials to identify patterns and opportunities for improvement:

- Categorize denials by reason code to identify your biggest weaknesses

- Track denial rates by insurance carrier to understand payer-specific requirements

- Monitor denial rates by provider to identify training needs

- Calculate financial impact of denials monthly to measure improvement

- Review denial trends to catch systemic issues early

Frequently Asked Questions About Dental Claim Denials

Take Action: Reduce Your Denial Rate Today

The statistics are clear: 20% of dental claims are denied on first submission, costing practices hundreds of thousands of dollars annually. But this doesn’t have to be your reality.

By implementing the five prevention strategies outlined in this guide—automated insurance verification, complete documentation, accurate coding, AI-powered validation, and comprehensive staff training—you can dramatically reduce your denial rate and keep revenue flowing smoothly.

- Patient information errors (23%) and missing documentation (18%) cause 41% of all denials

- The average cost to rework a denied claim is $117, with 65% never resubmitted

- Automated insurance verification reduces eligibility-related denials by 73%

- AI-powered claims validation catches errors before submission, improving approval rates by 12-15%

- Voice AI for periodontal charting saves time and ensures complete documentation

- Practices using comprehensive AI solutions reduce overall denials by 35-45%

The dental landscape is evolving rapidly, and practices that embrace AI dental software and automation are seeing measurable improvements in both efficiency and profitability. The question isn’t whether you can afford to invest in denial prevention technology—it’s whether you can afford not to.

Your Next Steps

- Audit your current denial rate – Calculate your baseline and financial impact

- Identify your biggest denial reasons – Review the past 3-6 months of denials

- Evaluate your current verification process – How much time does it take? How accurate is it?

- Research AI-powered solutions – Compare platforms and request demos

- Create an implementation plan – Set goals and timeline for reducing denials

🚀 Ready to Reduce Your Claim Denials by 40%+?

DentaliAssist combines AI-powered insurance verification, voice transcription for periodontal charting, and intelligent claims validation in one comprehensive platform.

✅ Automate verification across 300+ payers

✅ Voice AI for accurate clinical documentation

✅ Real-time claims validation before submission

✅ Proven to reduce denials by 35-45%

💰 See your potential ROI in the first meeting | No obligation